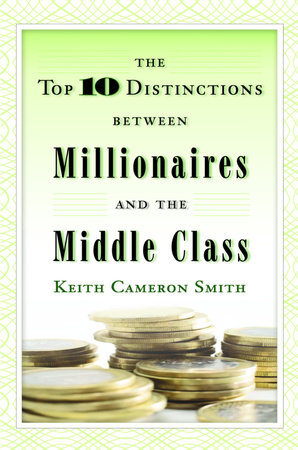

The Top 10 Distinctions Between Millionaires and the Middle Class by Keith Cameron Smith: 9780345500229 | PenguinRandomHouse.com: Books

USC football recruiting: Four-star OL Jason Zandamela commits as Trojans class enters top 10 - CBSSports.com