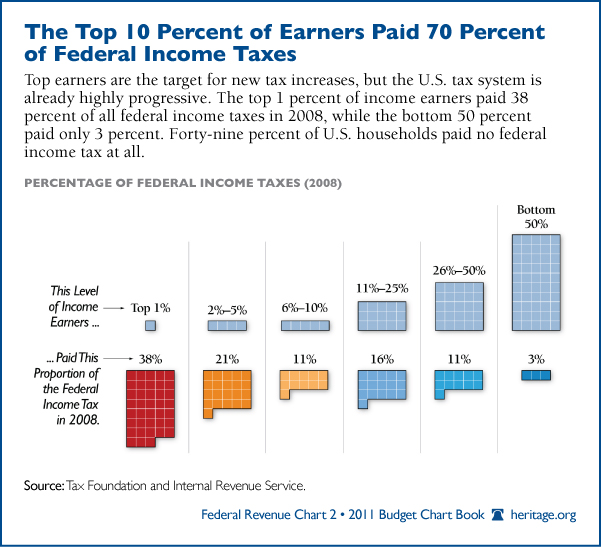

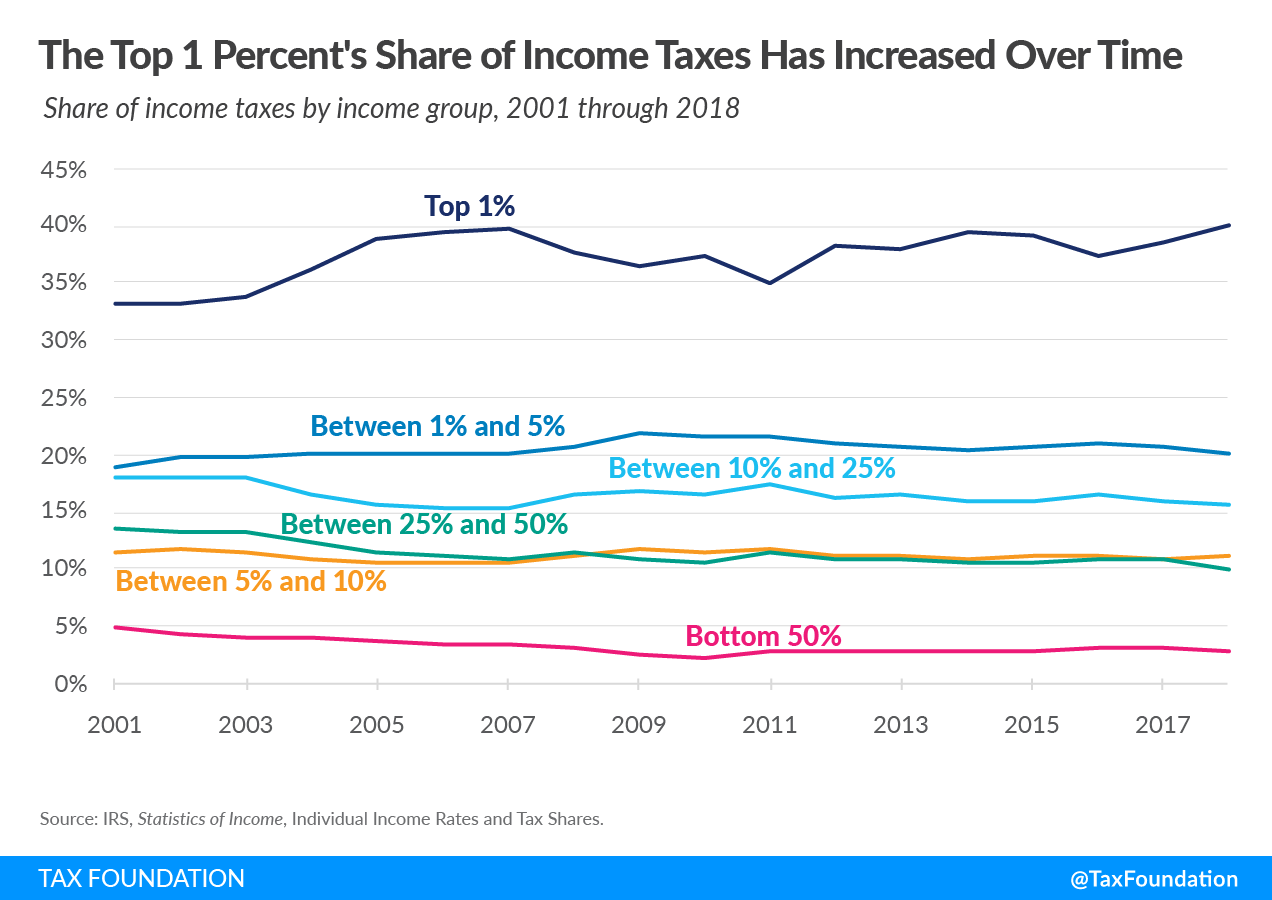

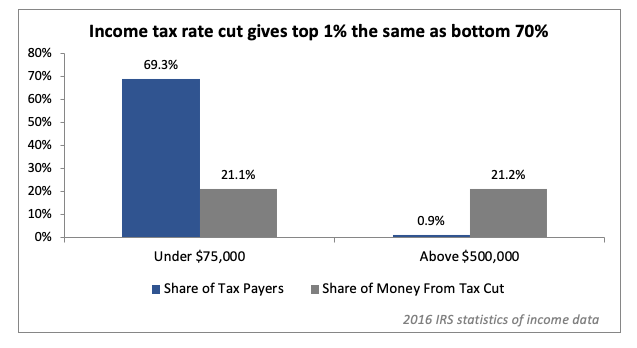

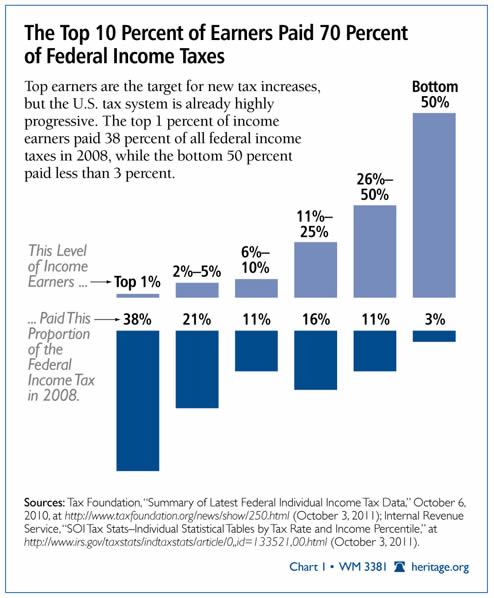

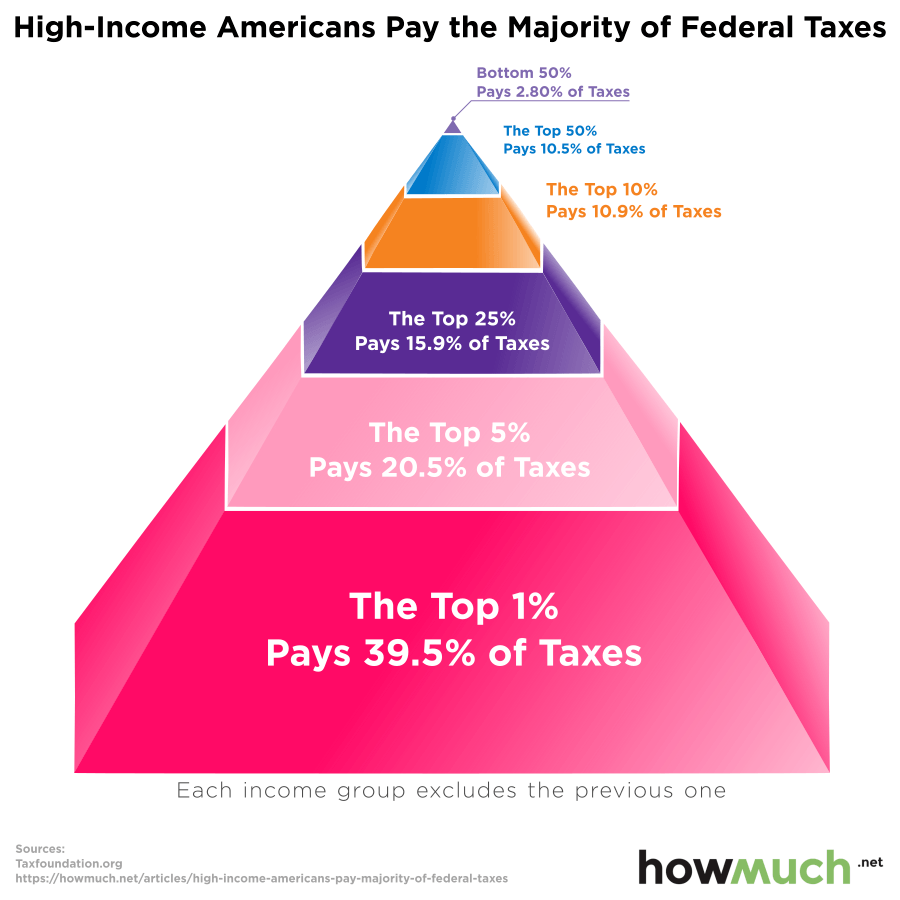

Can We Fix the Debt Solely by Taxing the Top 1 Percent? | Committee for a Responsible Federal Budget

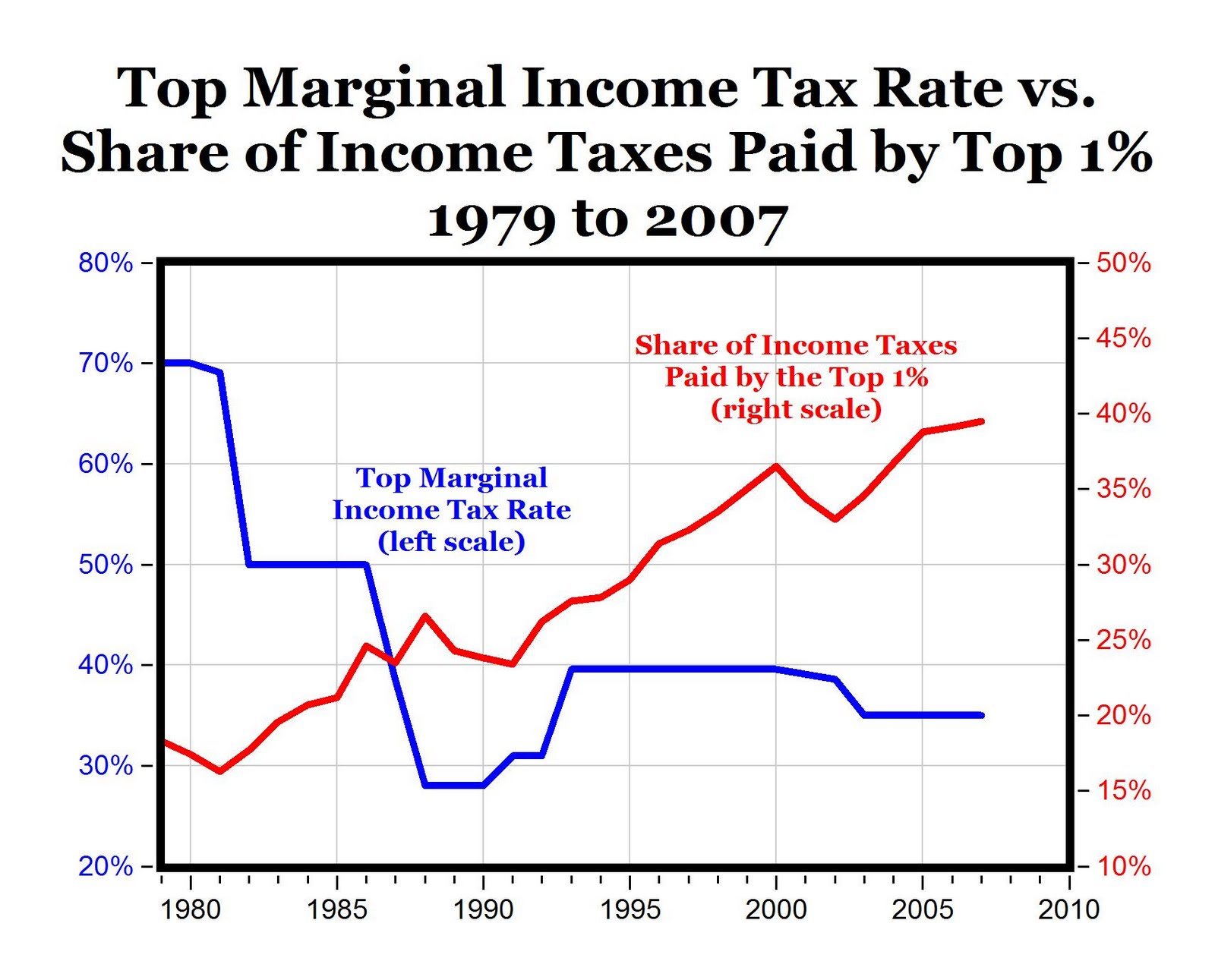

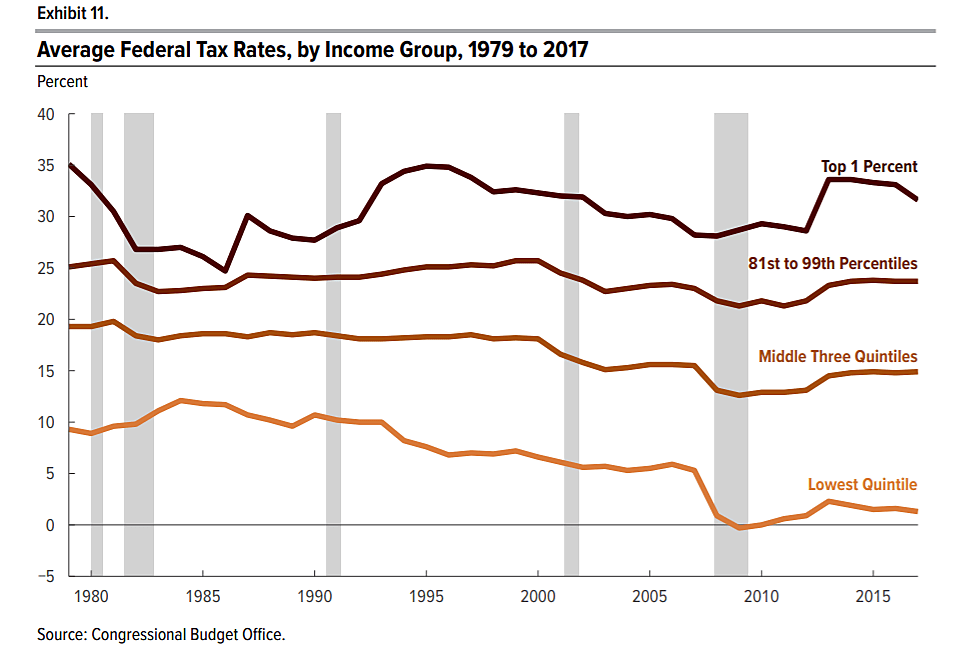

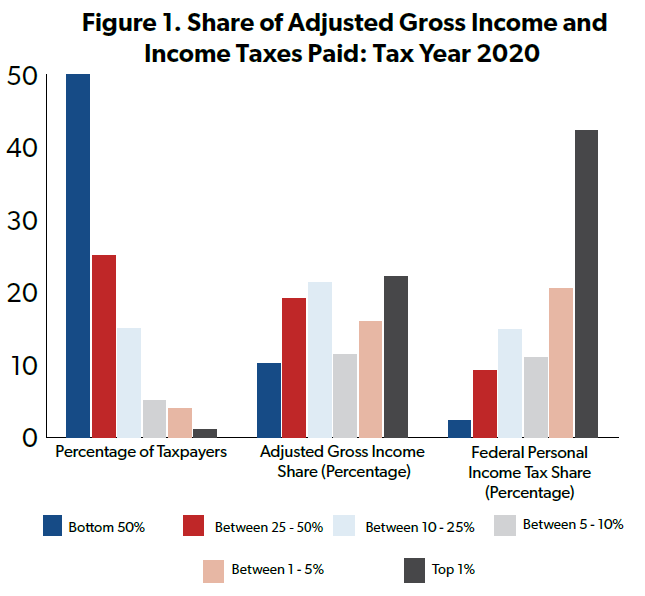

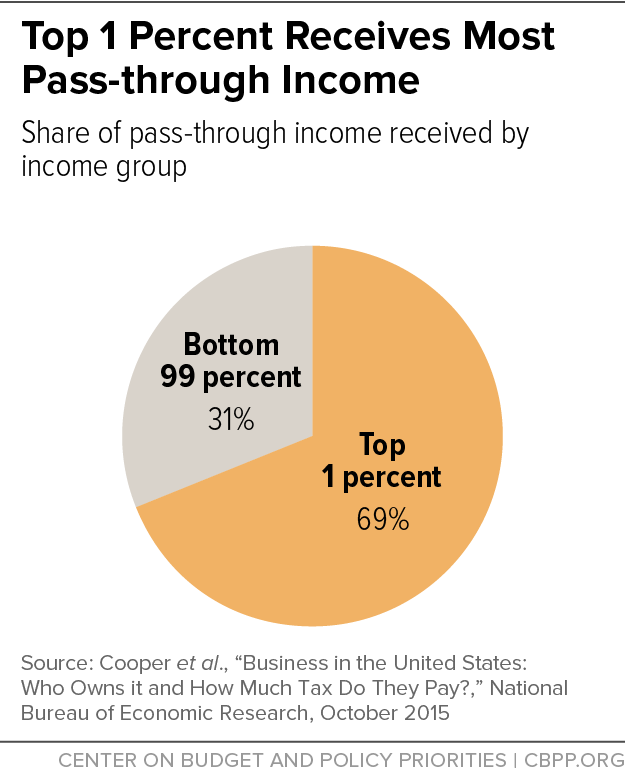

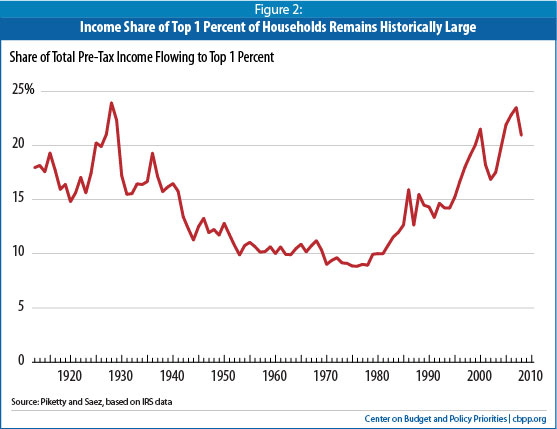

Tax Data Show Richest 1 Percent Took a Hit in 2008, But Income Remained Highly Concentrated at the Top | Center on Budget and Policy Priorities